Is the “student loan crisis” really a crisis?

Research shows that borrowing student loans is often more beneficial than harmful in the long-term — and that the "student loan crisis" is less of a crisis than some may think.

By Alix Poth ’18

Rising college tuition prices means more students have loan debt than ever. Presidential candidates often deem the current state of student loan debt a “crisis,” and promise to rid the county of higher education deficits.

The term “student loan crisis” implies student loans are inherently dangerous and should be avoided. The question arises: Are student loans always more harmful than beneficial? Professor Andrew Barr of the Department of Economics, a researcher of financial aid’s effects on students’ choices and outcomes, argues the answer is emphatically no — when handled with well-informed diligence.

Is it really a “crisis?”

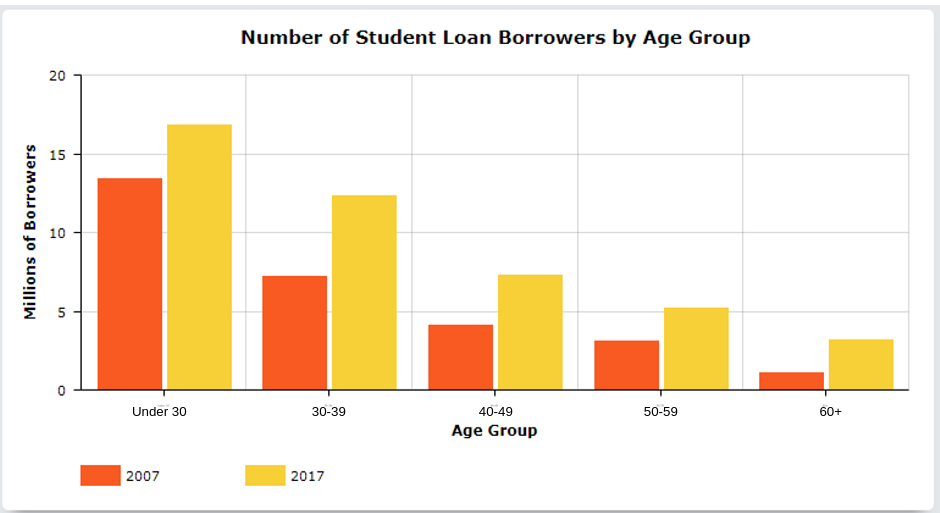

The number of student loan borrowers is on the rise in all age groups. Source: Federal Reserve Bank of New York Consumer Credit Panel / Equifax

“People talk a lot about the size of student loan debt, now over $1.5 trillion,” Barr said. “The top line number on debt is very high, but much of that debt is held by people who are doing quite well.”

Barr explained that the population with student loan debt is divided into three categories: individuals who are pursuing or have received graduate degrees that generally have high financial returns in the labor market (e.g., law and medical degrees); individuals who completed a bachelor’s or associate’s degree in a high-return field and usually have few problems paying off their debt; and the “crisis” group — a smaller group of individuals who enrolled in programs with low returns, or who failed to finish their degrees. Individuals in the “crisis” group frequently leave college with the same or worse job prospects as when they started and therefore struggle to repay their student loans.

Though the “crisis” group indeed faces many financial hardships, they make up the minority of those who have student loan debt in the country.

Are student loans more harmful or beneficial?

The use of student loans for the majority of people, Barr said, is highly beneficial.

“Many students have used student loans to access an education they otherwise would not have been able to pursue,” he said. “For most of these students, they are better off financially than they would have been.”

When used in a program or a college that has high rates of return in the job market, those students do not typically face difficulties in repaying the debt. Research shows that the majority of students are using loans responsibly, and are benefiting as a result. Indeed, recent research by Barr and others suggests that reducing loan borrowing appears to hinder academic success, and perhaps even increases the likelihood that individuals face difficulty with repayment.

The “crisis” group, however, is a smaller but sizable group of individuals who invested in an educational program that resulted in little to no boost to their income. Barr provided two main factors that have led to the expansion of this group: increased push for colleges to enroll non-traditional students, and a lack of transparency and accountability in projections of future employment.

“Many students have used student loans to access an education they otherwise would not have been able to pursue. They are better off financially than they would have been.”

To the first point, Barr said, “Some institutions recruited at-risk students aggressively, frequently with misleading promises of future employment. The ‘crisis’ was also likely worsened by the effects of the Great Recession, which led to weaker labor market outcomes for recent students.”

Most college programs lack transparency in what the return in the job market would be. Many students are resultantly left with little means of paying back debt when they unexpectedly end up low-income jobs.

“As more at-risk students were encouraged to enter and did enter the higher education system, the government made it easy for them to make bad choices,” Barr said.

Providing clearer information about job prospects can avoid potential harm caused by taking out student loans. Barr suggested providing accessible and candid information on the outcomes associated with certain courses of study to every person considering enrollment.

What do we do about the student loan crisis?

The majority of people with student loans have the ability to pay back their debt. Because of this, Barr said when looking at solutions for the existing pool of borrowers, the focus should be on the ones who, in many ways, were failed by the system and are now struggling with debt.

“Our system is actually set up to help this group of individuals already,” he said. “We have loan repayment options that allow people to pay back a small fraction of their disposable income each month (zero if they earn below a certain amount). After 20 years, any remaining debt is forgiven.”

The major issue is that many of the people that would benefit from this plan do not know to enroll in it. Barr suggested making it easier, perhaps even automatic, for borrowers to enter this repayment plan.

To the recurring suggestion that eliminating all student debt is the best solution, Barr said, “Eliminating all student loan debt isn’t a great idea… Nothing comes for free.” This action would increase national debt or require expenditure cuts in other areas.

“Most people are going to pay back their loans. If we eliminate their debt, we are basically making a transfer to people who are generally doing quite well,” he said. “Those with the largest amounts of debt are most often those with graduate degrees (MBAs, M.D.s, etc.) who will more than likely end up in the top of the income distribution.”

If universities provide transparent statistics about the job market, the “crisis” can be prevented from getting worse.

“The government should collect and provide information on institutions of higher education that better reflect the labor market and repayment outcomes of individuals who enroll in different institutions and programs,” he said. “If many students enrolling in a program experience poor outcomes and fail to repay their loans, the federal government should not finance those programs.”

An informed approach to handling student loans is crucial to allow the greatest number of students to benefit from them, and from higher education, without creating a personal or larger-scale crisis.

“The majority of individuals are now going to college, and the majority of those are financing their education with loans,” Barr said. “Student loans are an issue that many Americans have or will face personally.”

Learn more about Barr’s research here.